Hello, this is Sarah. This is another episode of how to do your own taxes. Thanks for joining us today. We're going to talk about the main form every individual has to file when they do their taxes every year. That form is called the 1040 form. 1040 can be found on the irs.gov website. Other places where you can find it are by calling the IRS 800 number and requesting it to be sent to you, or by going to the local post office. They usually have that form and a few other forms unless they run out. Another option is to go to the local tax office. If you have a computer, the easiest thing to do is to look it up on IRS.gov. You can put the form number and the form description in the search bar, and you'll find it instantly. We're going to find the 1040 form right here. Once you have completed your taxes, you can come back to the same page and click on "Your Refund" to check the status. You can also find more information about your refund by clicking over here. Additionally, you can learn about free filing by clicking here. This year, the IRS has partnered with several tax companies, including H&R Block and other online companies, to offer free filing for basic tax forms, such as the 1040 form. However, keep in mind that if you have extra forms, you may be charged for them. So, don't assume that your entire tax filing will be completely free. Also, note that you may not qualify for free filing if you make over fifty-eight thousand dollars. Now, let's move to the right of the page, and you'll see the first thing you need to do is fill in your name, address,...

Award-winning PDF software

What is 8889 Form: What You Should Know

IRS Form 8.pdf Mar 4, 2025 — Updated IRS Form 8889 (2015) instructions and Form 8889 (2014) instructions are now available. IRS Guidance For Establishing and Supporting The Health Savings Account Dec 29.2018 — IRS Revenue Procedure 2017-28, Income From Health Care. Dec 2, 2025 — IRS Revenue Procedure 2017-24, Health Cost Sharing Reductions (Part D). Dec 12, 2025 — Health Savings Accounts (Has) and Health Reimbursement Arrangements. Oct 14, 2025 — IRS Revenue Procedure 2017-13, Adjusting Tax Table for Health Cost Sharing Reductions (CTR). July 18, 2025 — IRS Revenue Procedure 2017-11, Adjusting the Tax Table to Account for CTR. June 19, 2025 — Health Savings Accounts (Has). June 18, 2025 — Health Savings Accounts and HSA Designations. May 25, 2025 — Health Savings Accounts. May 3, 2025 — IRS Revenue Procedure 2017-10, Changes to the Health Insurance Marketplace. IRS Revenue Procedure 2017-5, Establishing an Eligibility Date for HSA Conversion to Disability. May 2, 2025 — Establishing an Eligibility Date for the Health Savings Accounts (Has). April 4, 2025 — A general note on the Health Savings Accounts (HSA). Apr 6, 2025 — Health Savings Accounts (Has). Apr 1, 2025 — Health Savings Accounts (Has) and HSA Designations. March 31. 2025 — IRS Revenue Procedure 2017-9, Health and Retirement Account (HRA) Designations. March 9, 2025 — HSA Designation for Traditional Has, Has for Self-Employment, and Tax-Free Has. March 6, 2025 — Changes to the Health Insurance Marketplace. February 10, 2025 — The General Explanation of the 2025 Individual Income Tax Rates. January 26, 2025 – 2025 Form 1040, General Instructions for Filing. January 23, 2025 – 2025 Form 1040, General Instructions for Filing. January 8, 2025 – 2025 Form 1040, Gather Information About Your Income, Family Size and Assets, for Filing the IRS Federal income tax return. March 31, 2025 – 2025 Form 1040, Information About Your Gross Income, for Filing the IRS Federal income tax return.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8889, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8889 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8889 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8889 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

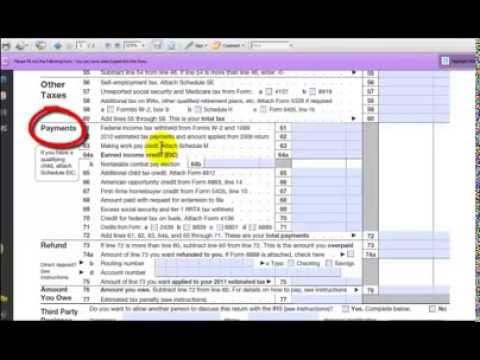

Video instructions and help with filling out and completing What Is Form 8889